Your Trusted Real Estate Advisors. Let Us Help You!

Home Buyers Face Less Competition Compared to a Year Ago in Mississauga and Brampton

Home buyers face less competition compared to a year ago in Mississauga and Brampton

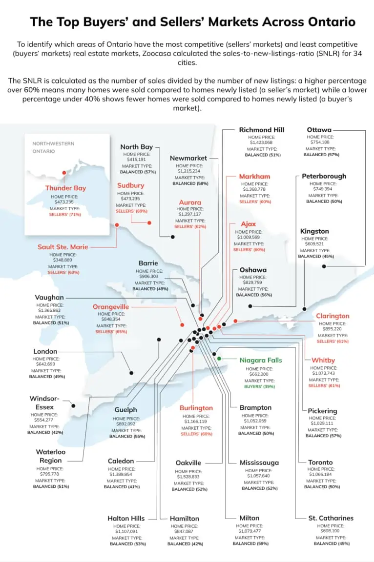

Those looking to buy a home in Brampton and Mississauga will find a much more balanced market compared to a year ago. Both cities are now in a balanced market, meaning demand for housing and supply are balanced, according to a report from real estate brokerage Zoocasa. Zoocasa analyzed market competition across 34 cities and regions in Ontario by comparing July sales and new listing data for each city. This data was then used to determine the sales-to-new-listings ratio for the month. The ratio is calculated by dividing the total sales by the number of new listings in each region.This helps those in the market to buy a home identify how much competition there is. Mississauga’s sales-to-new-listings-ratio for July 2023 was 52 per cent, down from a sellers market in July 2022 when the ratio was 61 per cent, according to the report.

Brampton’s sales-to-new-listings-ratio for July 2023 was 50 per cent, down from 58 per cent July 2022.

A sales-to-new-listings-ratio under 40 per cent suggests a buyer’s market — where new listings outweigh and buyers have more options, according to Zoocasa. Between 40 and 60 per cent is considered balanced.

And a ratio over 60 per cent is a seller’s market where demand outpaces supply, benefiting sellers.

Mississauga and Brampton are not alone — 23 of the 34 markets analyzed sit in a balanced state.

Oakville, Newmarket, Toronto, Pickering and Oshawa have all shifted into balanced territory from last year.

“This means that although inventory is tight in many of these markets, demand and supply are relatively balanced, however, it does not take into account the sideline buyers that are on the fence,” Zoocasa notes.

In each of these GTA markets except Mississauga, prices have also declined in the last month, according to Zoocasa.

The average price of all home types in Mississauga was $1,057,640 in July. Brampton’s average was slightly lower at $1,052,059.

Zoocasa attributes the cooling market to recent interest rate hikes. The last was in July when the Bank of Canada increased the overnight rate or key interest rate by .25 basis points to five per cent. The increase means borrowing costs are higher. But the Bank of Canada says they are trying to quell rising inflation.

While the market has cooled, it is still not affordable for many people.

So, where can buyers find a lower price?

There’s only one Ontario market that favours those looking for a home right now — Niagara Falls.

The sales-to-new-listings-ratio of the region is 39 per cent, with enough homes coming to market to satiate demand, according to the report.

The average price of all home types, at $662,200, is much lower than Mississauga, Brampton and the GTA.

For the complete report, see Zoocasa's blog.